Bank of America Merrill Edge accounts offer a compelling blend of investment options, robust research tools, and convenient account management. Whether you’re a seasoned investor or just starting out, Merrill Edge provides a platform to build your financial future. From diverse investment choices like stocks, bonds, and mutual funds to sophisticated research capabilities and helpful educational resources, Merrill Edge caters to a range of investment styles and goals.

This comprehensive guide will explore everything you need to know to successfully navigate the world of Merrill Edge investing.

So, you’re checking out Bank of America Merrill Edge accounts? Yeah, they’re alright, but if you’re thinking business, you might want to peep what Huntington Bank’s offering with their killer huntington bank business promo. Seriously, those perks might sway you. Then again, Merrill Edge has its own charms, right? It all depends on what you need.

We’ll delve into the specifics of account types, fees, and the step-by-step process of opening and managing your account. We’ll also cover crucial aspects like investment strategies, risk management, and the security measures in place to protect your assets. Get ready to unlock the potential of your investments with Merrill Edge!

Merrill Edge Account: A Hilariously Honest Review

So, you’re thinking about diving into the world of investing with Bank of America’s Merrill Edge? Buckle up, buttercup, because it’s a wild ride. We’re going to spill the tea (and maybe some spilled coffee, because let’s be honest, investing can be stressful) on everything you need to know about this platform. Prepare for a rollercoaster of information, delivered with the comedic timing of a seasoned stand-up comedian (who also happens to be a financial whiz).

Account Features and Benefits, Bank of america merrill edge account

Merrill Edge offers a buffet of investment options, from stocks and bonds to mutual funds and ETFs. Think of it as an all-you-can-eat investment smorgasbord, but with potentially higher returns (or lower, let’s be realistic). They even have fractional shares, so you can dabble in expensive stocks without breaking the bank (unless you’re REALLY into dabbling).

Merrill Edge offers several account types, each with its own quirks and fees. The Self-Directed brokerage account is the classic choice, perfect for those who like to call the shots. Then there’s the Advisory account, for those who prefer a little hand-holding (and are willing to pay for it). We’ll break down the differences in fees, minimums, and services in a handy-dandy table below.

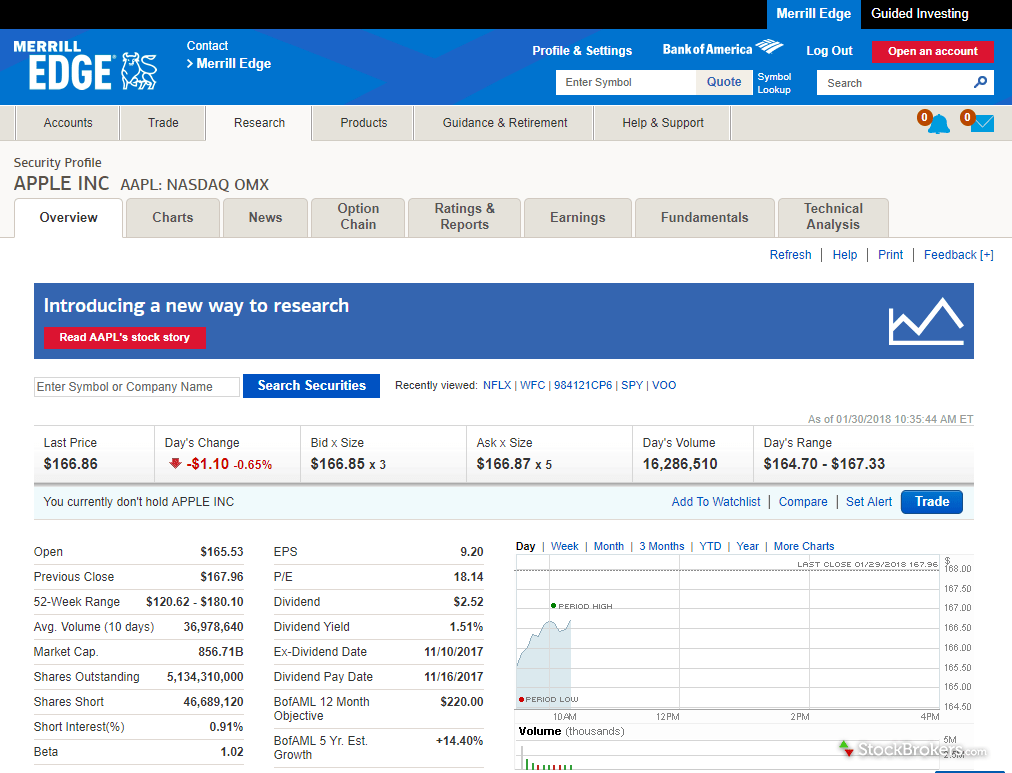

Research tools? Merrill Edge has ’em. Think of it as having a personal research assistant, only this one doesn’t complain about the coffee being cold. They offer market analysis, charting tools, and educational resources – all designed to make you feel like a Wall Street pro (even if you’re still wearing your pajamas).

| Feature | Merrill Edge | Fidelity | Schwab |

|---|---|---|---|

| Investment Options | Stocks, Bonds, ETFs, Mutual Funds | Stocks, Bonds, ETFs, Mutual Funds | Stocks, Bonds, ETFs, Mutual Funds |

| Research Tools | Yes, extensive | Yes, extensive | Yes, extensive |

| Account Minimums | Varies by account type | Varies by account type | Varies by account type |

Account Opening and Management

Source: stockbrokers.com

Opening a Merrill Edge account is easier than ordering a pizza online (almost). You’ll need some basic information, a few forms of ID, and a whole lot of hope. Funding your account is a breeze – you can transfer money from your Bank of America account or use a wire transfer (if you’re feeling fancy). Managing your account is pretty straightforward, though updating your personal information can be a bit like navigating a maze blindfolded.

Transferring assets from another brokerage? It’s doable, but prepare for some paperwork. Think of it as a bureaucratic scavenger hunt, where the prize is… more money (hopefully).

- Complete the account transfer form.

- Contact your previous brokerage firm.

- Wait (patiently, or not so patiently).

- Celebrate (with champagne, maybe?).

Investment Strategies and Tools

Merrill Edge doesn’t dictate your investment strategy. It’s your money, your choices. However, they provide the tools to help you navigate the wild world of investing. Whether you’re a risk-averse turtle or a thrill-seeking hare, Merrill Edge has resources to help you craft a plan that aligns with your financial goals and risk tolerance.

Tax implications? Oh boy, here we go. Let’s just say consulting a tax professional is always a good idea. Seriously, don’t rely on our hilariously inaccurate summaries.

Investment risks? They exist. Market fluctuations, inflation, even the unexpected arrival of a flock of pigeons disrupting your financial planning… The key is diversification and a healthy dose of patience (and maybe a good therapist).

Fees and Charges

Let’s talk money – or rather, the lack thereof, thanks to fees. Merrill Edge has various fees, including trading fees, account maintenance fees, and other charges that can nibble away at your profits. It’s like a tiny goblin stealing your hard-earned cash. Understanding these fees is crucial for maximizing your returns.

Here’s a (simplified) look at the fee structure:

- Trading Fees: Vary depending on the type of trade.

- Account Maintenance Fees: May apply depending on your account type and balance.

- Other Fees: A whole host of other fees can pop up, so be sure to read the fine print (or, you know, just hire a lawyer).

Customer Service and Support

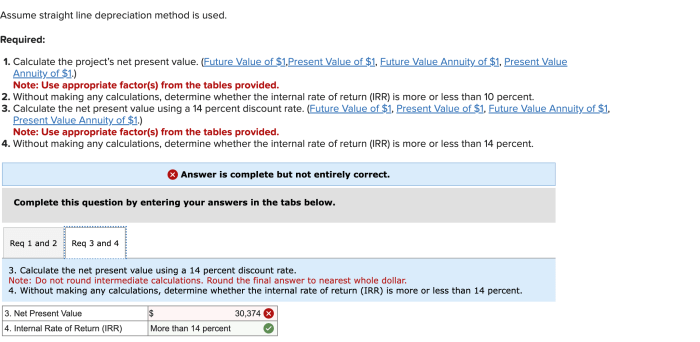

Source: cheggcdn.com

Need help? Merrill Edge offers several ways to get in touch – phone, online chat, email. It’s like having a dedicated support team at your fingertips (although their response time might vary depending on the time of day and the mood of the customer service representative).

Resolving issues? It can be a bit of a process, but persistence is key. Think of it as a game of patience, where the prize is a resolved issue.

| Support Channel | Availability | Contact Information |

|---|---|---|

| Phone | 24/7 | [Phone Number – Replace with Actual Number] |

| Online Chat | During Business Hours | [Website Link – Replace with Actual Link] |

| 24/7 | [Email Address – Replace with Actual Address] |

Security and Protection

Merrill Edge takes security seriously. They employ various measures to protect your account and personal information, including encryption and multi-factor authentication. Think of it as a fortress protecting your financial treasures from those pesky digital goblins.

Fraud prevention? They’ve got that covered too. Reporting suspicious activity is easy – just follow their guidelines and they’ll help you investigate. It’s like having a digital bodyguard watching your back.

Closing Summary: Bank Of America Merrill Edge Account

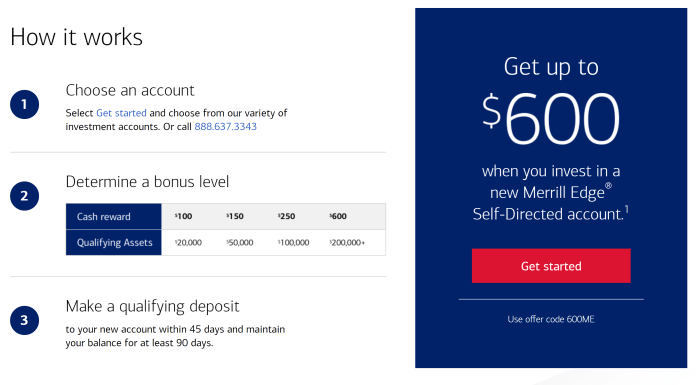

Source: frequentmiler.com

Ultimately, a Bank of America Merrill Edge account offers a powerful combination of accessibility, robust tools, and comprehensive support for investors of all levels. While fees and investment risks are inherent, understanding these factors and leveraging the resources available can significantly enhance your investment journey. By carefully considering your investment goals, risk tolerance, and utilizing the platform’s resources effectively, you can confidently navigate the world of investing with Merrill Edge.

So, are you ready to take control of your financial future?